The rise of artificial intelligence (AI) isn’t just a technological shift—it’s a revolution transforming industries worldwide, including insurance. Since ChatGPT brought generative AI to the masses in 2022, the way individuals and businesses operate has changed forever.

At INSHUR, we’re not just observers of this transformation—we’re at the forefront, responsibly leveraging AI to enhance our products and services in a highly regulated industry. As part of the team working to integrate AI into our business model, I’ve seen firsthand how transformative these technologies can be. In this blog post, I’ll explain what generative AI is, explore its applications and limitations, and share how INSHUR is actively and responsibly implementing this innovation.

What is Generative AI?

Generative AI refers to systems that can create new data—whether that’s text, images, or music—by learning from vast amounts of pre-existing data and patterns. These models are especially exciting because they can respond to natural language, something that has long been a challenge for computers.

Generative Pre-trained Transformer (GPT), the technology behind ChatGPT, is one popular example of generative AI. GPT transforms language inputs into meaningful outputs by learning from massive datasets. While GPT focuses on text, other models can generate images, music, or even code, all by recognising and creatively applying patterns from the data they’ve been trained on.

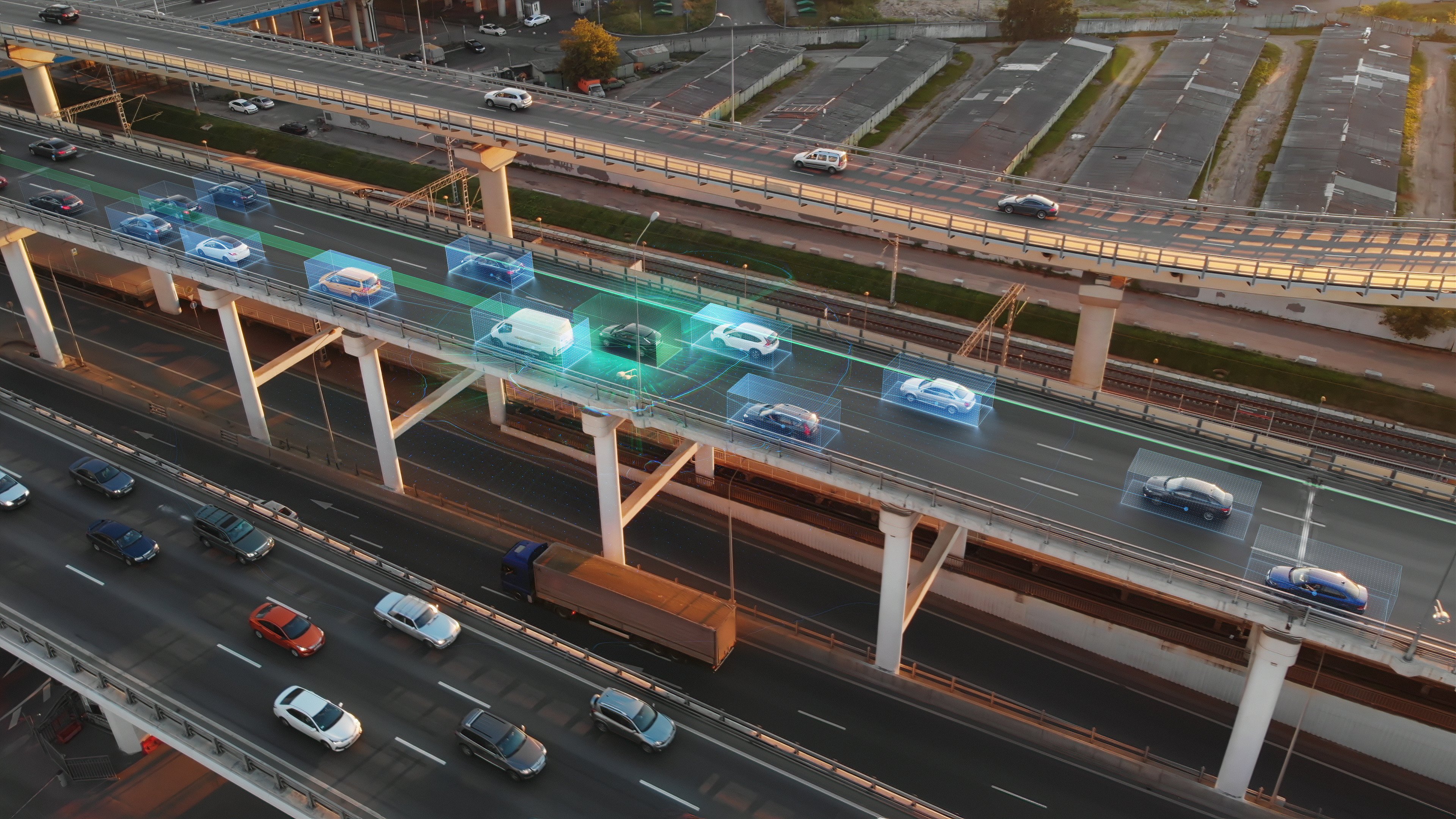

To make this clearer, let’s use a car analogy. If we want a model to understand how to create images of cars, we train it by showing thousands of images of various cars. Over time, the model learns the features that make up a car—wheels, engines, and chassis. With enough training, it can not only generate a basic car image, but also combine learned elements to create more complex and various images, like sporty coupes or futuristic electric vehicles. Just as a driver learns to appreciate different car models and their nuances, the model develops an understanding of styles, colours, and design features, enabling it to produce unique and tailored images based on specific prompts.

How INSHUR is Using Generative AI

In the highly regulated insurance sector, strict legal guidelines govern how we operate. For example, AI cannot directly advise customers on insurance—that responsibility lies with licensed brokers. However, there are many ways generative AI can be safely and legally leveraged to improve our internal processes.

One area where AI has had a transformative impact is in our claims department. 5Sigma, a cloud-native claims management platform, helps us handle claims efficiently across multiple jurisdictions. It provides robust claims logic, tailored to meet regulatory and operational needs for various insurance companies. While 5Sigma is an excellent tool for managing the claims workflow, it currently lacks comprehensive inbound communication management and the seamless ability to associate all communications with specific claims. That's where our own AI solution comes in, augmenting 5Sigma with INSHUR’s unique approach to handling the thousands of communications we receive daily.

Previously, manually sorting through each email to assess its priority was time-consuming. Now, with the advanced summarisation and categorisation capabilities of AI, we can quickly evaluate the content and urgency of emails and their attachments. This empowers our team to manage their workflow more efficiently and respond to communications more effectively.

Beyond email handling, generative AI categorises communications (e.g., identifying litigation, broker emails, police reports, and medical records) and provides concise summaries of various attachments, including images, PDFs, and documents. We’ve integrated this technology with 5Sigma, creating a unified source of truth for all claim-related data. These enhancements provide our claims team with a streamlined system to manage communications, track metrics, and ensure that every case is handled swiftly and efficiently.

Looking ahead, we aim to extend generative AI into areas such as fraud detection. Fraudulent claims cost the UK insurance industry over £1 billion annually, raising premiums for honest customers. With AI’s ability to identify subtle patterns in data, we can develop systems that stay ahead of evolving fraud schemes, automate detection processes, reduce costs, and ultimately pass these savings on to our customers.

Challenges, Limitations and Mitigations

Generative AI is not a silver bullet. It comes with significant challenges, and at INSHUR, we believe building responsible AI systems starts with understanding and addressing these risks. Here’s how we’re tackling some of the biggest challenges:

Data Gaps

Generative AI can only produce outputs based on what it’s been trained on. Let’s return to our car analogy: if the AI has seen lots of images of cars but never a truck, it won’t know how to generate one. In an insurance context such as fraud detection, if AI has only been trained on American driver’s licences, it won’t be able to accurately assess British licences. That’s why comprehensive data is crucial to the tasks AI is assigned.

Hallucinations

Have you ever asked ChatGPT a question and received a wildly incorrect answer? This is known as “hallucination,” where AI generates false information with unwarranted confidence. It’s a major problem, particularly in regulated industries like insurance, where accuracy is critical. Hallucinations happen because AI models generate responses by predicting what should come next, sometimes without grounding in factual data. Since hallucinations are an inherent risk, we mitigate them by using AI for tasks that involve human oversight, like communication summarisation and fraud detection. This way, every AI output is reviewed and validated by our team before it’s acted upon.

Prompt Injection

Prompt injection is a security risk where users manipulate AI by embedding unintended instructions into their inputs. In some cases, this can lead to the AI generating harmful or misleading content. For example, an attacker could subtly manipulate input data to trick the AI into providing unauthorised access to sensitive information. At INSHUR, we rigorously test our systems to protect against this vulnerability, introducing layers of validation and limiting the scope of what AI can access to prevent prompt injection.

Consumer Trust

Finally, one of the most important considerations is consumer trust. Many people are still unsure about AI, especially in industries like insurance, where the stakes are high. That’s why transparency is key. At INSHUR, we emphasise that AI is used to support our operations, not replace human expertise. AI helps us serve customers more quickly and accurately, but every decision is backed by human judgement. By fostering transparency and accountability, we aim to build and maintain the trust of our customers as we continue to embrace the future of AI.

Conclusion

Generative AI has revolutionised the way we work, offering both exciting opportunities and significant challenges. At INSHUR, we’re embracing this technology to enhance our operations, streamline communications, and explore future innovations like fraud detection. However, we remain acutely aware of AI’s limitations, including hallucinations, data gaps, and security vulnerabilities like prompt injection. Our commitment to responsible AI use ensures that human oversight and consumer trust remain central to every AI-powered process.

As AI continues to evolve, so too will its applications in the insurance sector. But no matter how advanced these systems become, maintaining transparency, accountability, and trust is essential. AI is a powerful tool that, when used responsibly, improves efficiency and reduces costs, but it will always require the guidance of human intelligence and ethical decision-making.

At INSHUR, we’re leading the charge by combining cutting-edge technology with responsible business practices. As we continue to innovate with AI, we remain dedicated to ensuring that these advancements benefit not only our business but also the customers we serve.

Written by George Smith.

.png)